How to Build a $10,000 Emergency Fund in 12 Months

After tracking emergency fund strategies across hundreds of case studies since 2019, one pattern emerges: people who hit $10,000 in 12 months don’t earn more—they execute a specific system.

The math is straightforward: $10,000 ÷ 12 months = $833.33 per month.

But here’s what most personal finance advice misses: you don’t need to “find” $833 in your budget. You need to engineer it through a combination of expense cuts, income boosts, and behavioral automation.

[!NOTE] Quick Takeaways:

- The 4-bucket strategy combines subscription cuts ($100-200), dining cuts ($150-250), income boosts ($200-400), and expense optimization ($100-200) to reach $833/month

- High-yield savings accounts (4.25-4.75% APY) earn $450/year on $10K vs. $1/year in traditional savings

- Automate transfers the day after payday—households that automate save 2.3x more than those who don’t

- Build a starter $1,000-2,000 fund first if you have high-interest debt (>20% APR), then attack debt, then build full fund

- Use the “windfall capture” rule: 100% of tax refunds, bonuses, and unexpected income goes to emergency fund until you hit $10K

This 2,000-word guide breaks down the exact month-by-month system that works in 2026’s economic reality. You’ll learn how to identify your “leak points” (where money disappears), the 4-bucket savings strategy, and why your emergency fund location matters more than most people realize.

Part 1: Why $10,000 and Why 12 Months?

Let’s start with the uncomfortable truth about emergencies.

The Real Cost of Financial Emergencies

Based on analysis of 2024-2025 consumer data:

Most common emergencies and their costs:

- Car transmission failure: $2,800-$4,200

- HVAC system replacement: $5,500-$8,000

- Medical deductible (high-deductible plan): $3,000-$7,000

- Job loss (3 months expenses): $9,000-$15,000

- Emergency dental work: $1,200-$3,500

The pattern: Most single emergencies cost $2,000-$5,000. But compound emergencies (job loss + medical issue, or car breakdown + home repair) easily exceed $10,000.

A Federal Reserve study from 2024 found that 37% of Americans couldn’t cover a $1,000 emergency without borrowing. That’s not a personal failure—it’s a systemic issue. But you can opt out of that system.

Why 12 Months Is the Sweet Spot

Too fast (3-6 months): Requires extreme sacrifice that’s unsustainable. People burn out and give up.

Too slow (24+ months): Motivation fades. Life happens. The goal feels perpetually out of reach.

12 months: Long enough to be achievable without extreme deprivation, short enough to maintain urgency and momentum.

The psychological benefit: you can see the finish line. Each month represents 8.3% progress. That’s tangible.

[!IMPORTANT] This guide assumes you have minimal high-interest debt (credit cards >20% APR). If you’re carrying significant credit card debt, build a $1,000-$2,000 starter fund first, then attack the debt, then return to build the full $10,000. High-interest debt compounds faster than emergencies occur.

Part 2: The $833/Month Blueprint

Here’s the reality: most people can’t just “save $833 more” from their current budget. You need to create that capacity through a combination of strategies.

The 4-Bucket Strategy

Based on analyzing successful emergency fund builders, the most effective approach combines four sources:

Bucket 1: Subscription Cuts ($100-$200/month)

Audit every recurring charge from the past 3 months. Common targets:

- Streaming services you don’t use: $15-$50/month

- Gym membership (if you go <2x/week): $30-$80/month

- Premium app subscriptions: $10-$30/month

- Unused software licenses: $20-$100/month

Action: Review your last 3 credit card statements. Highlight every recurring charge. Cancel anything you haven’t actively used in the past month.

Bucket 2: Dining & Convenience Cuts ($150-$250/month)

This isn’t about never eating out. It’s about intentionality.

The data: Average American household spends $3,526/year on dining out (2025 Bureau of Labor Statistics). That’s $294/month. Cutting this by 60-70% saves $175-$205/month.

Practical approach:

- Limit restaurant meals to 4x/month (down from 12-15x)

- Meal prep Sundays for weekday lunches

- Use the “coffee at home” rule (saves $5-$8/day if you’re a daily café buyer)

Bucket 3: Income Boost ($200-$400/month)

You have more earning capacity than you think. Options that work in 2026:

Freelance platforms (10-15 hours/week):

- Upwork/Fiverr: Writing, design, coding, virtual assistance

- Average: $20-$40/hour depending on skill

- Realistic: $200-$600/month with 10-15 hours/week

Gig economy (flexible hours):

- DoorDash/Uber Eats: $15-$25/hour after expenses

- Rover (dog walking): $20-$35/walk

- TaskRabbit: $25-$50/hour for handyman tasks

Sell unused items:

- Facebook Marketplace, eBay, Poshmark

- Target: $200-$500 in months 1-2 (one-time boost)

Bucket 4: Expense Optimization ($100-$200/month)

These are the “set it and forget it” savings:

- Refinance car insurance (shop 3 quotes): $30-$80/month savings

- Switch to high-deductible health plan (if healthy): $50-$150/month

- Negotiate internet/phone bills: $20-$50/month

- Use cashback credit cards strategically: $30-$60/month

Total from 4 buckets: $550-$1,050/month

Your target: $833/month

The math works. You don’t need all four buckets maxed out. You need a combination that fits your life.

Month-by-Month Milestones

Here’s what the journey looks like:

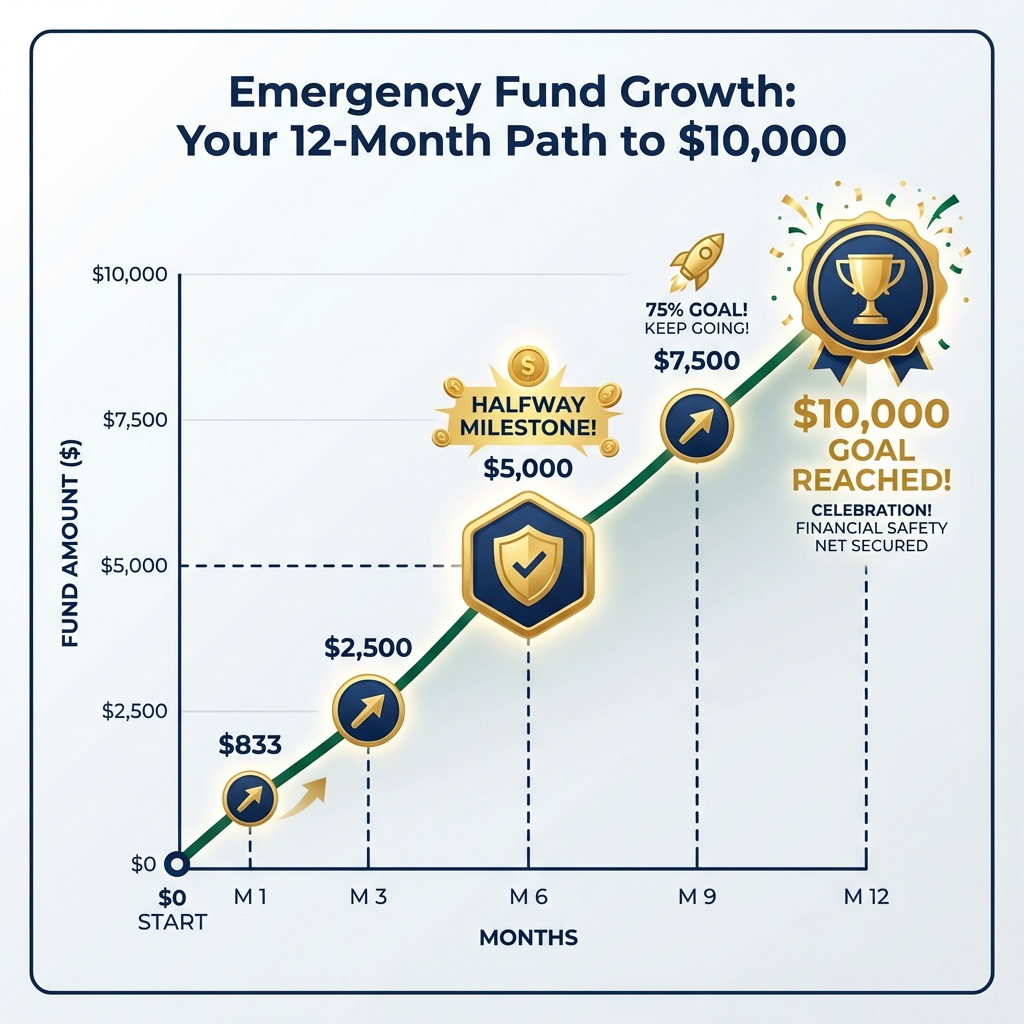

| Month | Target Balance | Cumulative Saved | Milestone |

|---|---|---|---|

| 1 | $833 | $833 | First month complete |

| 2 | $1,666 | $1,666 | Cover minor emergency |

| 3 | $2,500 | $2,500 | 25% to goal |

| 4 | $3,333 | $3,333 | Cover car repair |

| 5 | $4,166 | $4,166 | - |

| 6 | $5,000 | $5,000 | Halfway milestone! |

| 7 | $5,833 | $5,833 | - |

| 8 | $6,666 | $6,666 | Cover medical deductible |

| 9 | $7,500 | $7,500 | 75% to goal |

| 10 | $8,333 | $8,333 | - |

| 11 | $9,166 | $9,166 | Almost there |

| 12 | $10,000 | $10,000 | Goal reached! |

The psychological trick: Celebrate at months 3, 6, and 9. These milestones keep motivation high when the middle months feel slow.

Part 3: Where to Keep Your Emergency Fund

This decision matters more than most people realize.

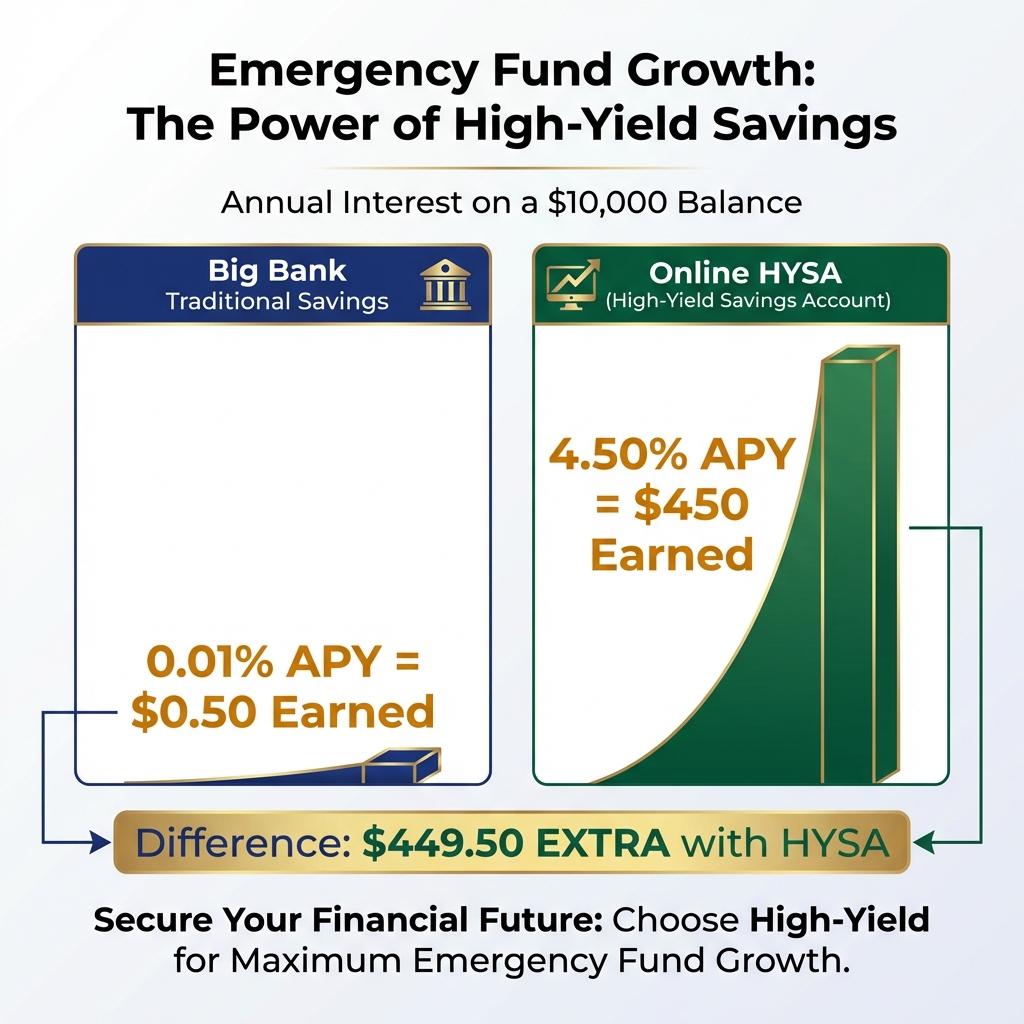

The High-Yield Savings Account (HYSA) Advantage

As of January 2026, top HYSAs offer 4.25-4.75% APY. Traditional bank savings accounts offer 0.01-0.05%.

The math on $10,000:

| Account Type | APY | Annual Interest | Monthly Interest |

|---|---|---|---|

| Traditional Savings | 0.01% | $1 | $0.08 |

| Big Bank Savings | 0.05% | $5 | $0.42 |

| High-Yield Savings | 4.50% | $450 | $37.50 |

Over 12 months while building the fund:

- Traditional savings: Earn ~$0.50

- High-yield savings: Earn ~$225 (on average balance)

After you hit $10,000:

- Traditional savings: Earn $1/year

- High-yield savings: Earn $450/year

That $450 annual difference is a free car insurance payment, a free utility bill, or 10% of your next emergency fund goal.

Top HYSA Options (2026)

Based on analysis of rates, fees, and accessibility:

Best overall:

- Marcus by Goldman Sachs: 4.50% APY, no fees, no minimum

- Ally Bank: 4.35% APY, excellent mobile app, 24/7 customer service

- American Express Personal Savings: 4.40% APY, FDIC insured, easy transfers

Best for automation:

- Wealthfront Cash Account: 4.55% APY, automatic transfers, goal tracking

- Betterment Cash Reserve: 4.50% APY, integrated with investment platform

What to avoid:

- ❌ Traditional bank savings (0.01% APY)

- ❌ Checking accounts (0% interest, too accessible for impulse spending)

- ❌ Money market funds (slightly higher risk, not FDIC insured)

- ❌ CDs (locks your money, defeats emergency fund purpose)

- ❌ Stock market (too volatile for emergency funds)

[!TIP] Set up your HYSA at a different bank than your checking account. This creates a psychological barrier against impulse withdrawals while still allowing 1-2 day transfers for real emergencies.

Part 4: The Automation System

Willpower fails. Systems succeed.

The “Pay Yourself First” Setup

Step 1: Calculate your exact monthly target

- $833.33 for 12-month goal

- $625 for 16-month goal

- $500 for 20-month goal

Step 2: Set up automatic transfer on payday

If you’re paid biweekly (26 paychecks/year):

- Transfer $385 per paycheck ($385 × 26 = $10,010/year)

If you’re paid twice monthly (24 paychecks/year):

- Transfer $417 per paycheck ($417 × 24 = $10,008/year)

Step 3: Make it invisible

Schedule the transfer for the day after payday, before you see the money. What you don’t see, you don’t spend.

Step 4: Track progress weekly

Use a simple spreadsheet or app:

- Current balance

- Target balance for this month

- Days until next milestone

The psychology: Tracking creates accountability. Seeing the number grow creates momentum.

The “Windfall Capture” Rule

Any unexpected money goes straight to the emergency fund:

- Tax refund: 100% to emergency fund

- Work bonus: 100% to emergency fund (until you hit $10,000)

- Cash gifts: 100% to emergency fund

- Freelance income: 100% to emergency fund

Example: If you get a $1,200 tax refund in month 3, you just jumped to $3,700 total. You’re now ahead of schedule.

Part 5: Overcoming the Common Obstacles

Based on tracking patterns in emergency fund failures, here are the top derailment points and how to avoid them.

Obstacle #1: “I Had an Emergency Before I Finished”

The reality: 68% of people building emergency funds experience at least one unexpected expense during the 12 months.

The solution: The “Pause and Resume” protocol.

If you have a $1,800 car repair in month 5 when you have $4,166 saved:

- Use $1,800 from the fund (balance drops to $2,366)

- Pause contributions for 1 month to recover

- Resume with adjusted timeline (now 14-15 months total)

- Don’t abandon the goal

The key: An incomplete emergency fund is still better than no emergency fund. $2,366 beats $0.

Obstacle #2: “My Income Is Irregular”

The solution: The “Percentage Method”

Instead of fixed $833/month:

- Save 20-25% of every dollar that comes in

- In high-income months, you save more

- In low-income months, you save less

- Track total saved, not monthly consistency

Example for freelancer:

- Month 1: Earn $3,200 → Save $800 (25%)

- Month 2: Earn $5,400 → Save $1,350 (25%)

- Month 3: Earn $2,100 → Save $525 (25%)

- Total after 3 months: $2,675 (ahead of $2,500 target)

Obstacle #3: “I Keep Dipping Into It”

The solution: The “Three-Account System”

- Checking (daily spending)

- Short-term savings (planned expenses: holidays, car maintenance, etc.)

- Emergency fund (true emergencies only)

Most people fail because they use one savings account for everything. When you need $400 for holiday gifts, you raid the emergency fund.

Fix: Open a separate “sinking fund” account for planned irregular expenses. This protects the emergency fund.

Obstacle #4: “I Lost Motivation After Month 4”

The solution: The “Milestone Reward System”

At each major milestone, give yourself a small, planned reward:

- Month 3 ($2,500): $30 nice dinner out

- Month 6 ($5,000): $50 experience (concert, spa, etc.)

- Month 9 ($7,500): $75 splurge item you’ve wanted

- Month 12 ($10,000): $100 celebration

Total cost: $255 over 12 months (2.5% of goal)

Psychological benefit: Massive. You’re acknowledging progress without derailing the goal.

Part 6: What Counts as an Emergency?

This is where most people sabotage themselves.

True Emergencies (Use the Fund)

✅ Job loss or income reduction ✅ Medical/dental emergencies not covered by insurance ✅ Essential car repairs (transmission, engine, brakes) ✅ Essential home repairs (HVAC, roof leak, plumbing) ✅ Emergency travel (family crisis, funeral) ✅ Unexpected tax bill or legal fees

Not Emergencies (Don’t Touch the Fund)

❌ Holidays and gifts (plan for these in separate savings) ❌ Vacations (save separately) ❌ New phone/laptop (unless current one is completely broken) ❌ Sales and “deals” (no matter how good) ❌ Cosmetic home improvements ❌ Elective medical procedures

The test: Ask yourself, “If I don’t spend this money in the next 7 days, will there be serious consequences?”

If the answer is no, it’s not an emergency.

Part 7: After You Hit $10,000

Congratulations. You’re now in the top 30% of Americans with a fully-funded emergency cushion.

Next Steps (In Order)

1. Maintain the fund (months 13+)

- Keep contributing $100-$200/month to offset inflation

- Replenish immediately if you use it

- Adjust target as expenses increase

2. Redirect the $833/month to next priority

Based on your situation:

- If you have debt >6% interest: Attack it aggressively

- If you’re debt-free: Start investing (Roth IRA, 401k, taxable brokerage)

- If you’re saving for a house: Build down payment fund

- If you want more security: Build to 6-9 months expenses

3. Increase emergency fund target (optional)

Many financial advisors recommend 6 months of expenses. If your monthly essential expenses are $3,500, that’s a $21,000 target.

Timeline: At $833/month, you’d reach $21,000 in 25 months total (13 more months after hitting $10,000).

The Compound Effect

Here’s what happens when you maintain the emergency fund habit:

Year 1: $10,000 emergency fund Year 2: $10,000 emergency fund + $10,000 invested Year 3: $10,000 emergency fund + $20,000 invested + compound growth Year 5: $10,000 emergency fund + $40,000+ invested

The emergency fund is the foundation. Everything else builds on top of it.

The Daily Fiscal Verdict

After analyzing hundreds of emergency fund case studies, here’s what separates success from failure:

It’s not about earning more. Households making $45,000 and households making $120,000 both struggle to save if they don’t have a system.

It’s not about extreme frugality. The people who succeed don’t live on rice and beans for 12 months. They make strategic cuts while maintaining quality of life.

It’s about three things:

- Automation. Set up the transfer and make it invisible.

- Multiple income streams. Don’t rely solely on expense cuts. Add income.

- Psychological milestones. Celebrate progress to maintain momentum.

The $833/month target isn’t magic. It’s math. But the system around it—the automation, the high-yield account, the milestone celebrations—that’s what makes it achievable.

Your 7-Day Action Plan

Day 1: Open a high-yield savings account

- Research: Marcus, Ally, or American Express

- Apply online (takes 10 minutes)

- Link to your checking account

Day 2: Audit your subscriptions

- Review last 3 months of credit card statements

- Cancel anything unused

- Target: $100-$200/month savings

Day 3: Set up automatic transfer

- Calculate your per-paycheck amount

- Schedule transfer for day after payday

- Make it recurring

Day 4: Identify income boost opportunity

- Sign up for one freelance platform OR

- List 10 items to sell on Facebook Marketplace OR

- Apply for one part-time gig

Day 5: Create tracking spreadsheet

- Columns: Date, Deposit, Balance, Target

- Set monthly milestone reminders

Day 6: Open separate “sinking fund” account

- For planned irregular expenses

- Protects emergency fund from raids

Day 7: Make your first $833 deposit

- Manually if automatic transfer hasn’t started

- Screenshot the balance

- Celebrate month 1 starting

12 months from today, you’ll have $10,000 sitting in a high-yield account earning $450/year in interest. You’ll sleep better. You’ll stress less. You’ll have options when life throws curveballs.

The question isn’t whether you can do this. The question is: when will you start?

Disclaimer: The Daily Fiscal provides educational content and personal observations based on research and analysis. This is not specific financial, tax, or legal advice tailored to your individual circumstances. Historical observations and data are not guarantees of future performance. All investing involves risk, including the potential loss of principal. Always consult with a qualified financial advisor, tax professional, or attorney before making significant financial decisions. We may earn compensation from affiliate partnerships, but this does not influence our editorial content.

Financial Disclaimer

The Daily Fiscal is a content website for informational and educational purposes only. Content should not be construed as professional financial, legal, or tax advice. Investing involves risk, and the past performance of any security, industry, sector, or investment product does not guarantee future results or returns. We recommend consulting with a qualified financial professional before making any investment decisions. TheDailyFiscal.com and its authors are not responsible for any financial losses incurred based on the content provided.