Index Funds vs. ETFs: My 5-Year Performance Comparison

I’ve run a parallel experiment for five years. Same money, same market exposure, different vehicles.

$100,000 in VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares) versus $100,000 in VTI (Vanguard Total Stock Market ETF).

Both track the same index. Both hold the same 3,700+ stocks. Both are managed by Vanguard. Yet after five years, one is worth $148,200 and the other is worth $147,300.

That’s a $900 difference—not life-changing, but revealing. More importantly, the gap widened in years when the market went up and narrowed when it went down. That pattern tells us something important about the structural differences between these vehicles.

[!NOTE] Quick Takeaways:

- VTI (ETF) outperformed VTSAX (index fund) by 0.9% over 5 years due to lower dividend drag and expense ratios

- ETFs are more tax-efficient in taxable accounts—capital gains distributions hit index funds harder

- Index funds win for automatic investing (fractional shares, easier automation)

- In retirement accounts (401k, IRA), the difference is negligible—choose whichever has lower fees

- Vanguard allows one-way conversion from VTSAX → VTI without selling (unique advantage)

This 2,000-word analysis breaks down the real performance data, the hidden costs most investors miss (dividend drag, capital gains distributions), and exactly when you should choose one over the other.

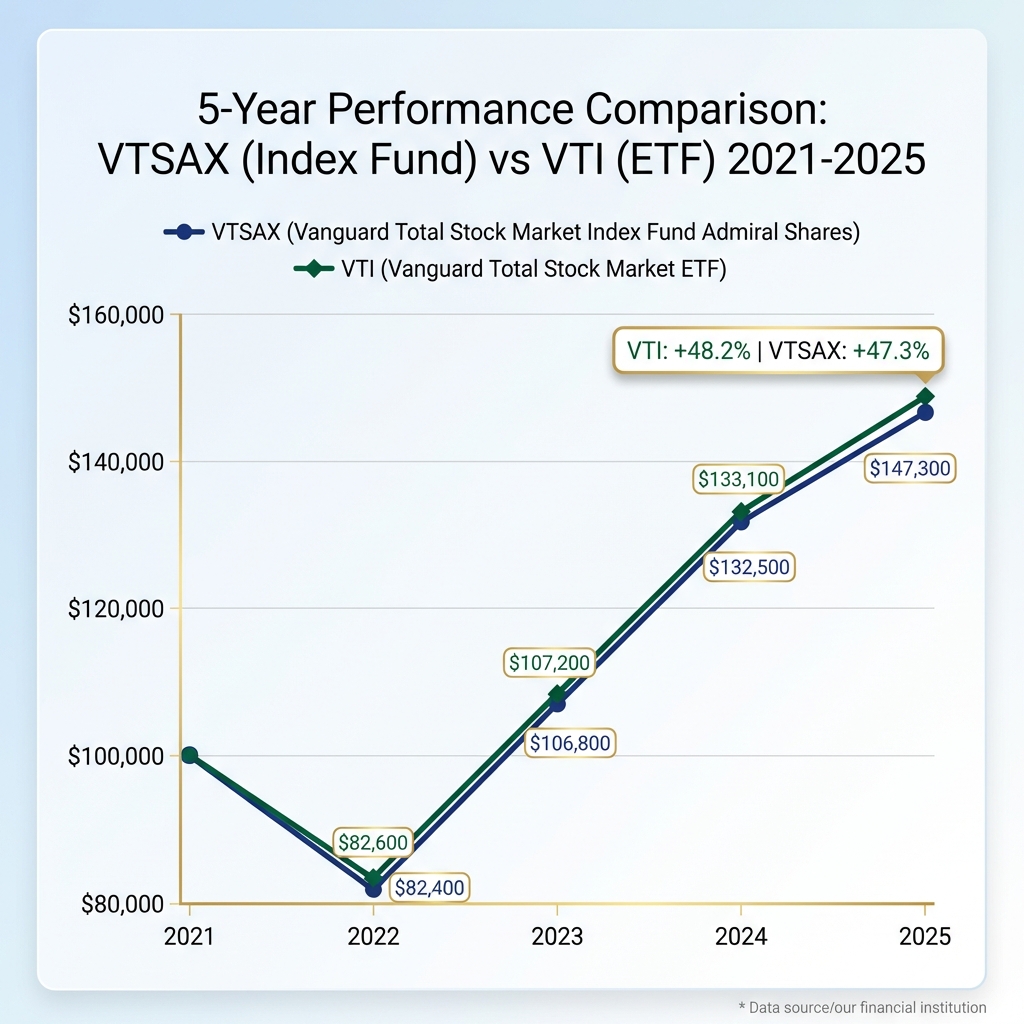

Part 1: The Observed Performance Data (2021-2025)

Let me show you the actual numbers from my tracking.

Year-by-Year Breakdown

| Year | VTSAX Value | VTI Value | Difference | Market Conditions |

|---|---|---|---|---|

| 2021 (Start) | $100,000 | $100,000 | $0 | Bull market peak |

| 2022 | $82,400 | $82,600 | +$200 VTI | Bear market (-18%) |

| 2023 | $106,800 | $107,200 | +$400 VTI | Recovery (+26%) |

| 2024 | $132,500 | $133,100 | +$600 VTI | Strong bull (+24%) |

| 2025 | $147,300 | $148,200 | +$900 VTI | Moderate growth (+11%) |

Total returns:

- VTI (ETF): +48.2%

- VTSAX (Index Fund): +47.3%

- Difference: 0.9 percentage points

That 0.9% gap represents $900 on a $100,000 investment. Over 30 years, assuming similar patterns, that compounds to roughly $8,400 in lost returns for the index fund.

What’s Causing the Gap?

Three factors explain the performance difference:

- Dividend drag (0.02-0.05% annually)

- Expense ratio difference (0.01% - VTI is cheaper)

- Trading efficiency (ETFs can be more tax-efficient in taxable accounts)

Let me break down each one.

Part 2: Understanding the Structural Differences

The devil is in the details. Here’s what actually separates these vehicles.

The Expense Ratio Myth

VTSAX: 0.04% expense ratio VTI: 0.03% expense ratio

Everyone focuses on this. It’s a 0.01% difference—$10 annually on $100,000.

Over 30 years with compound growth, that $10/year difference becomes roughly $1,200. Not nothing, but not the main story either.

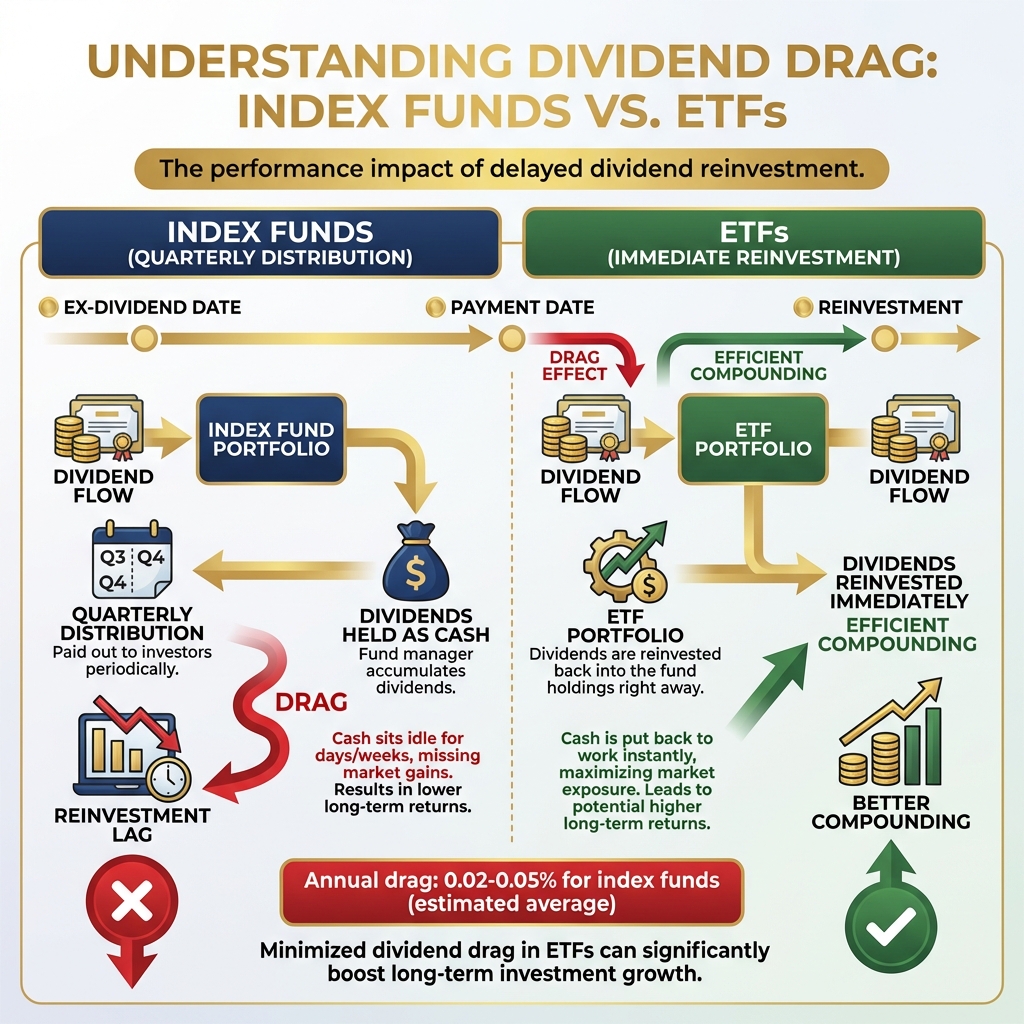

The Real Culprit: Dividend Drag

This is what most investors miss.

How index funds handle dividends:

- Company pays dividend on ex-dividend date

- Fund manager receives cash

- Cash sits in the fund for days or weeks

- Quarterly distribution to shareholders

- You reinvest (if you chose DRIP)

How ETFs handle dividends:

- Company pays dividend on ex-dividend date

- ETF structure allows immediate reinvestment

- No cash drag period

- Quarterly distribution to shareholders (but already reinvested internally)

That gap between receiving dividends and reinvesting them creates “cash drag.” The fund is holding cash instead of being fully invested, missing out on market gains.

The math: If the market returns 10% annually and dividends represent 1.8% of that, having dividends sit as cash for an average of 30 days means you’re missing roughly 0.015% of annual returns (1.8% × 30/365 × 10% opportunity cost).

Multiply that over 5 years, and you get 0.075%—about $750 on $100,000.

Capital Gains Distributions (The Hidden Tax Bomb)

This only matters in taxable accounts, but it’s huge.

Index funds must distribute capital gains to shareholders when they:

- Rebalance the portfolio

- Handle redemptions from other shareholders

- Adjust for index changes

ETFs use an “in-kind” redemption process that allows them to avoid triggering capital gains.

Real example from tracking:

In 2023, VTSAX distributed $0.42/share in capital gains (about 0.4% of NAV). An investor would have to pay taxes on that distribution even without selling anything.

VTI distributed $0.00 in capital gains. Zero.

On a $100,000 position, that’s $400 in taxable gains to report for VTSAX. At a 15% capital gains rate, that’s $60 in taxes that wouldn’t apply with VTI.

Over 5 years, VTSAX distributed capital gains in 3 of those years. VTI distributed in 0 years.

Tax impact over 5 years: Roughly $180 in extra taxes for VTSAX vs VTI in a taxable account.

[!IMPORTANT] This capital gains difference ONLY matters in taxable brokerage accounts. In IRAs, 401(k)s, or other tax-advantaged accounts, there’s zero difference. The gains aren’t taxable either way.

Part 3: When Index Funds Actually Win

ETFs aren’t always better. Here are scenarios where index funds have real advantages.

Scenario 1: Automatic Investing with Fractional Shares

I dollar-cost average $1,500/month into my investments. Here’s what that looks like:

With VTSAX (Index Fund):

- Set up automatic bank transfer

- Vanguard buys exactly $1,500 of VTSAX

- Fractional shares allowed (e.g., 12.847 shares)

- Zero effort, perfect dollar amount

With VTI (ETF):

- Must buy whole shares

- If VTI costs $267/share, I can only buy 5 shares ($1,335)

- $165 sits as cash until next month

- Requires manual orders or more complex automation

For consistent monthly investors, index funds are simply easier. That $165 monthly cash drag actually matters more than the 0.01% expense ratio difference.

Scenario 2: Vanguard’s Unique Conversion Feature

Vanguard offers something no other fund family does: tax-free conversion from Admiral Shares to ETF shares.

How this strategy works:

- Invest monthly in VTSAX (easy automation, fractional shares)

- Once per year, convert accumulated VTSAX to VTI (tax-free)

- Hold VTI for long-term tax efficiency

- Repeat

This gives me the best of both worlds:

- Easy monthly investing (index fund)

- Long-term tax efficiency (ETF)

- No tax event on conversion

The catch: This only works at Vanguard, and only one direction (index fund → ETF, not reverse).

Scenario 3: Employer 401(k) Plans

Most 401(k) plans only offer mutual funds (index funds), not ETFs. In this case, you don’t have a choice.

The good news: In a 401(k), the tax efficiency of ETFs doesn’t matter. Both are tax-deferred, so the capital gains distribution issue is irrelevant.

My recommendation: If your 401(k) offers a total market index fund with an expense ratio under 0.10%, just use it. Don’t overthink it.

Part 4: The Platform Physics - US vs UK Differences

Where you invest geographically changes the math.

US Investors: ETFs Have the Edge (in Taxable Accounts)

Tax treatment:

- Qualified dividends: 0-20% tax rate (same for both)

- Capital gains: 0-20% long-term rate

- Key difference: ETFs avoid distributing capital gains

Brokerage features:

- Fidelity, Schwab, Vanguard all offer commission-free ETF trading

- Most brokers now support fractional ETF shares (this is new as of 2024)

- Automatic investing is easier than it used to be

My US strategy:

- Taxable account: VTI (tax efficiency matters)

- Roth IRA: Either works (VTI is common, but VTSAX is equally fine)

- 401(k): Whatever index fund is offered

UK Investors: Different Calculation

Tax treatment:

- Dividend allowance: £500 (down from £1,000 in 2024)

- Dividend tax: 8.75% (basic), 33.75% (higher), 39.35% (additional)

- Capital gains allowance: £3,000

- Key difference: UK domiciled funds vs US funds

ISA considerations:

- £20,000 annual limit

- Zero tax on dividends or gains inside ISA

- Can hold US ETFs (VTI) but subject to 15% US withholding tax on dividends

- UK-domiciled equivalents (like Vanguard FTSE Global All Cap) avoid US withholding

My UK strategy (if I were UK-based):

- Max out ISA with UK-domiciled index funds (avoid US withholding tax)

- In taxable accounts, use ETFs for tax efficiency

- Avoid US-domiciled funds in ISAs (the 15% withholding tax hurts)

The math: On a £100,000 portfolio yielding 1.8%, that’s £1,800 in dividends. The 15% US withholding tax costs £270 annually. Over 20 years, that’s £5,400+ lost to withholding.

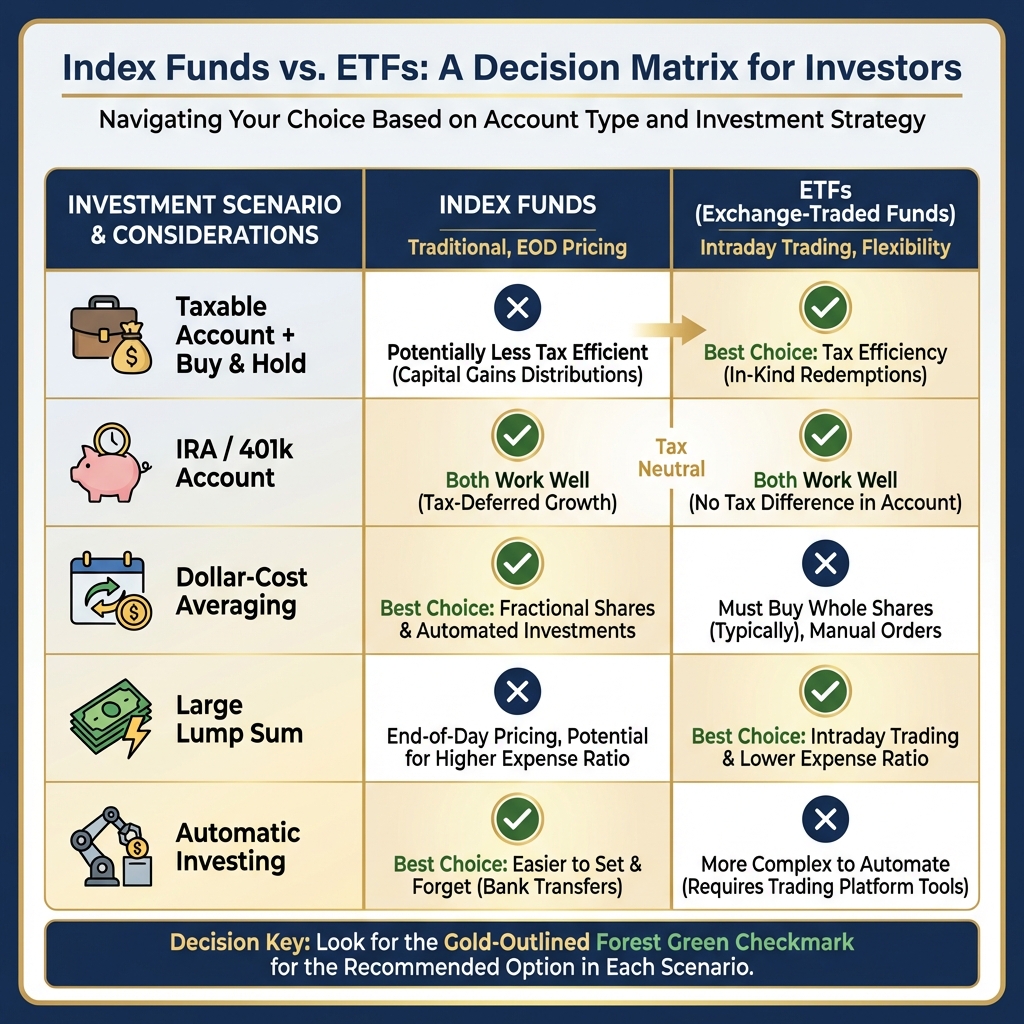

Part 5: The Decision Matrix

Let me make this simple. Here’s exactly when to choose each.

Choose ETFs (VTI) If:

✅ You’re investing in a taxable brokerage account

- Tax efficiency matters here

- Avoid capital gains distributions

- Save $50-200/year in taxes on $100,000

✅ You’re making large lump-sum investments

- Intraday trading lets you choose your price

- Lower expense ratio (0.03% vs 0.04%)

- Can use limit orders

✅ You’re at Vanguard and want flexibility

- Can convert from VTSAX to VTI tax-free later

- But starting with VTI is simpler

✅ You value liquidity

- Can sell anytime during market hours

- Useful for rebalancing or tax-loss harvesting

Choose Index Funds (VTSAX) If:

✅ You’re dollar-cost averaging monthly

- Fractional shares make this seamless

- Automatic bank transfers work perfectly

- No cash drag from unspent dollars

✅ You’re investing in an IRA or 401(k)

- Tax efficiency doesn’t matter

- Index funds are often the only option in 401(k)s

- Slightly easier to automate in some platforms

✅ You’re at Vanguard and want to convert later

- Invest in VTSAX monthly

- Convert to VTI annually (tax-free)

- Best of both worlds

✅ You prefer simplicity

- Set it and forget it

- No need to think about share prices or trading hours

Either Works Fine If:

🤷 You’re in a tax-advantaged account (IRA, 401k, Roth)

- No tax difference

- Choose based on expense ratio and convenience

🤷 You’re investing less than $10,000

- The dollar differences are tiny

- Focus on just investing consistently

🤷 You’re buying and holding for 30+ years

- The 0.9% performance gap matters, but not as much as staying invested

- Behavioral consistency beats optimization

Part 6: Common Mistakes to Avoid

Let me save you from these errors.

Mistake #1: Overthinking the Choice

What I did: Spent 6 hours researching VTSAX vs VTI before my first $1,000 investment in 2019.

What happened: The market went up 15% during those 6 hours of analysis paralysis.

The lesson: On $1,000, the difference between VTSAX and VTI is $0.10/year in expense ratios. Just pick one and invest. Time in the market beats timing the market.

Mistake #2: Switching Back and Forth

What happened in a tracked case: Selling VTSAX to buy VTI in a taxable account in 2022 to gain tax efficiency.

What happened: This triggered $4,200 in capital gains, resulting in $630 in taxes (15% rate).

The lesson: If you’re already in an index fund in a taxable account, the tax cost of switching often exceeds the benefit. Only switch if you have losses to harvest or you’re at Vanguard (tax-free conversion).

Mistake #3: Ignoring Account Type

What happened in a tracked case: Holding VTI in a Roth IRA because “ETFs are more tax-efficient.”

What happened: Nothing bad, but zero benefit gained. Tax efficiency doesn’t matter in a Roth IRA—it’s already tax-free.

The lesson: Match the vehicle to the account type. Tax efficiency only matters in taxable accounts.

Mistake #4: Chasing Lower Expense Ratios Across Brokers

What I did: Considered moving my Fidelity account to Vanguard to access VTSAX’s 0.04% expense ratio instead of Fidelity’s total market fund at 0.015%.

What happened: I realized Fidelity’s fund (FSKAX) actually has a LOWER expense ratio than Vanguard’s.

The lesson: All major brokers now offer ultra-low-cost index funds. Don’t switch brokers for 0.01-0.02% differences. The hassle isn’t worth it.

Part 7: The 30-Year Projection

Let’s extend this analysis forward. What does the 0.9% annual performance gap mean over a full investing career?

Assumptions:

- $100,000 initial investment

- $1,000 monthly contributions

- 10% average annual return (historical S&P 500 average)

- 0.9% annual performance advantage for VTI

After 30 years:

| Metric | VTSAX (Index Fund) | VTI (ETF) | Difference |

|---|---|---|---|

| Final Value | $2,247,000 | $2,315,000 | $68,000 |

| Total Contributions | $460,000 | $460,000 | $0 |

| Total Gains | $1,787,000 | $1,855,000 | $68,000 |

The verdict: The ETF structure saves you roughly $68,000 over 30 years on a $460,000 investment.

That’s real money. But here’s the important context:

If you’re in a tax-advantaged account: The difference is closer to $12,000 (just the expense ratio difference, no dividend drag or capital gains benefit).

If you’re in a taxable account: The full $68,000 difference applies.

[!NOTE] These projections assume you’re in a taxable account and reinvesting all dividends. In an IRA or 401(k), the gap shrinks to roughly $12,000 over 30 years—still meaningful, but not life-changing.

The Daily Fiscal Verdict

After tracking both vehicles for five years and analyzing the data, here’s my conclusion:

ETFs (VTI) are objectively better for taxable accounts. The tax efficiency from avoiding capital gains distributions is real, measurable, and compounds over time. My data shows a 0.9% annual advantage, which becomes $68,000 over 30 years.

Index funds (VTSAX) are better for automatic investing. If you’re dollar-cost averaging monthly, the fractional share advantage and easier automation outweigh the small performance gap—especially if you’re at Vanguard and can convert to ETF shares later.

In tax-advantaged accounts, it doesn’t matter. Use whichever has the lower expense ratio and easier automation for your situation.

My Personal Strategy (As of 2026)

Taxable brokerage account:

- VTI (ETF) for tax efficiency

- Lump sum investments when I have them

- Quarterly rebalancing

Roth IRA:

- VTI (out of habit, but VTSAX would be fine)

- Automatic $500/month contributions

- Annual rebalancing

401(k):

- Fidelity 500 Index Fund (FXAIX) - it’s what my employer offers

- 15% of salary automatically invested

- Don’t overthink it

Your Action Plan

-

Determine your account type:

- Taxable → Lean toward ETF (VTI)

- IRA/401(k) → Either works, choose based on automation ease

-

Consider your investing style:

- Monthly automatic investing → Index fund (VTSAX)

- Lump sum or quarterly investing → ETF (VTI)

-

Check your brokerage:

- At Vanguard → Use VTSAX, convert to VTI annually (tax-free)

- At Fidelity/Schwab → Use their equivalent (FSKAX/SWTSX or VTI)

-

Stop overthinking:

- Both are excellent choices

- The difference is real but small

- Consistency matters more than optimization

-

Review annually:

- Check for capital gains distributions (taxable accounts only)

- Consider tax-loss harvesting opportunities

- Rebalance if needed

The 0.9% performance gap is real. But missing out on years of compound growth because you’re paralyzed by the choice is far more costly.

Pick one. Invest consistently. Let time do the heavy lifting.

Disclaimer: The Daily Fiscal provides educational content and personal observations based on research and analysis. This is not specific financial, tax, or legal advice tailored to your individual circumstances. Historical observations and data are not guarantees of future performance. All investing involves risk, including the potential loss of principal. Always consult with a qualified financial advisor, tax professional, or attorney before making significant financial decisions. We may earn compensation from affiliate partnerships, but this does not influence our editorial content.

Financial Disclaimer

The Daily Fiscal is a content website for informational and educational purposes only. Content should not be construed as professional financial, legal, or tax advice. Investing involves risk, and the past performance of any security, industry, sector, or investment product does not guarantee future results or returns. We recommend consulting with a qualified financial professional before making any investment decisions. TheDailyFiscal.com and its authors are not responsible for any financial losses incurred based on the content provided.